Developing drugs for rare diseases, once a rare phenomenon itself, has now become a standard strategy for many companies’ drug development pipelines. With only five percent of rare diseases currently having treatments, there’s a significant opportunity to address unmet medical needs. The 1983 Orphan Drug Act (ODA) in the USA marked a pivotal moment, transforming rare disease drug development into a lucrative venture. Once a drug is designated as an orphan, the sponsor gains benefits under ODA, including tax credits, clinical research subsidies, and grants for development costs. Importantly, ODA provides seven years of market exclusivity upon approval, preventing the FDA from approving generic drugs or biosimilars for the same indication. This legislative move aimed to incentivize pharmaceutical companies to invest in drugs for small patient populations. The EU later passed an equivalent bill in 2000. Drug developers have adeptly navigated these rules, seeking orphan status even for therapies with broader potential usage. With around 6,800 rare diseases globally, focusing on them allows drug makers to generate robust clinical data with limited patient populations, facilitating a quicker path to regulatory approval and significantly reducing development costs compared to more common diseases. As a result, major pharmaceutical players are shifting their focus from blockbusters to niche-busters.

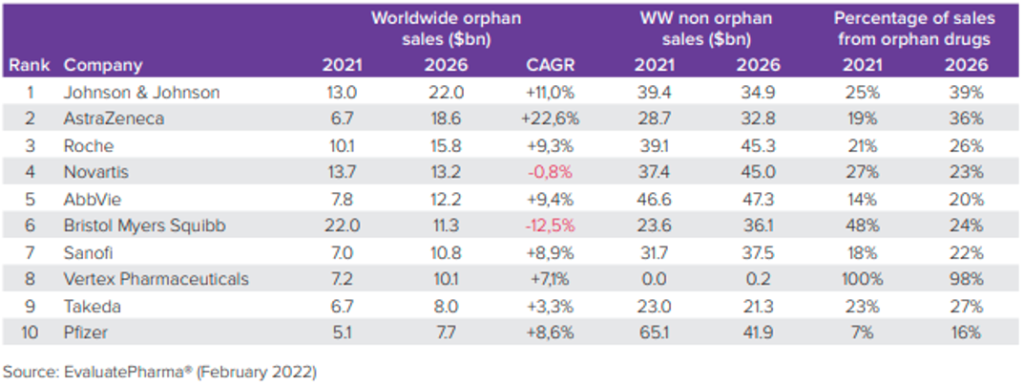

The growth of orphan drug sales is racing ahead, surpassing the broader pharmaceutical market. Once considered niche, these products are now mainstream, with more than half of the FDA’s 2021 approvals being orphan drugs designed for rare diseases. Projections suggest that by 2026, orphan drugs will contribute to one-fifth of all prescription drug sales and nearly one-third of the total value of the global drug pipeline. In 2021, orphan drugs with FDA’s Center for Drug Evaluation and Research (CDER) approvals took the lead, marking a significant shift in the pharmaceutical landscape.

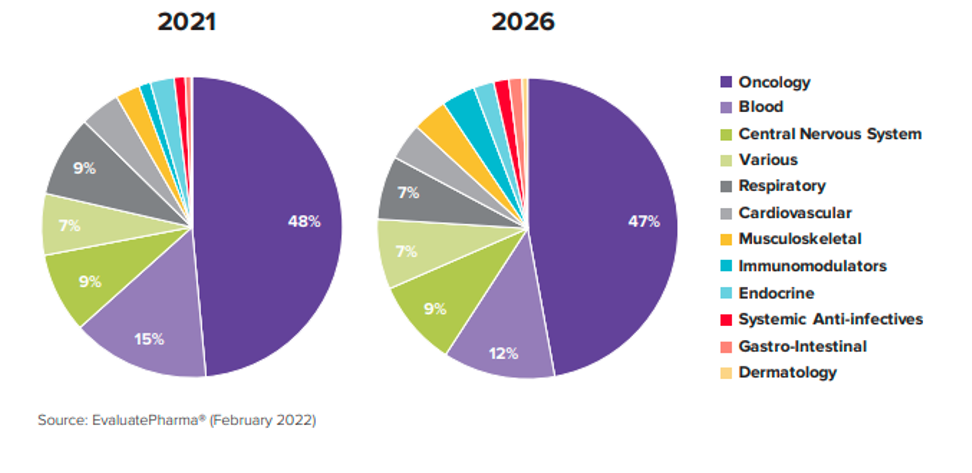

Exploring the realm of orphan drugs reveals a distinct landscape, with the top five therapeutic areas commanding attention. Oncology takes the lead, claiming 48% of orphan drug designations, followed by Hematology (12%), the nervous system (9%), and respiratory conditions (9%). Notably, half of the top ten are dedicated to oncology, emphasizing the enduring prominence of cancer within the orphan drug arena

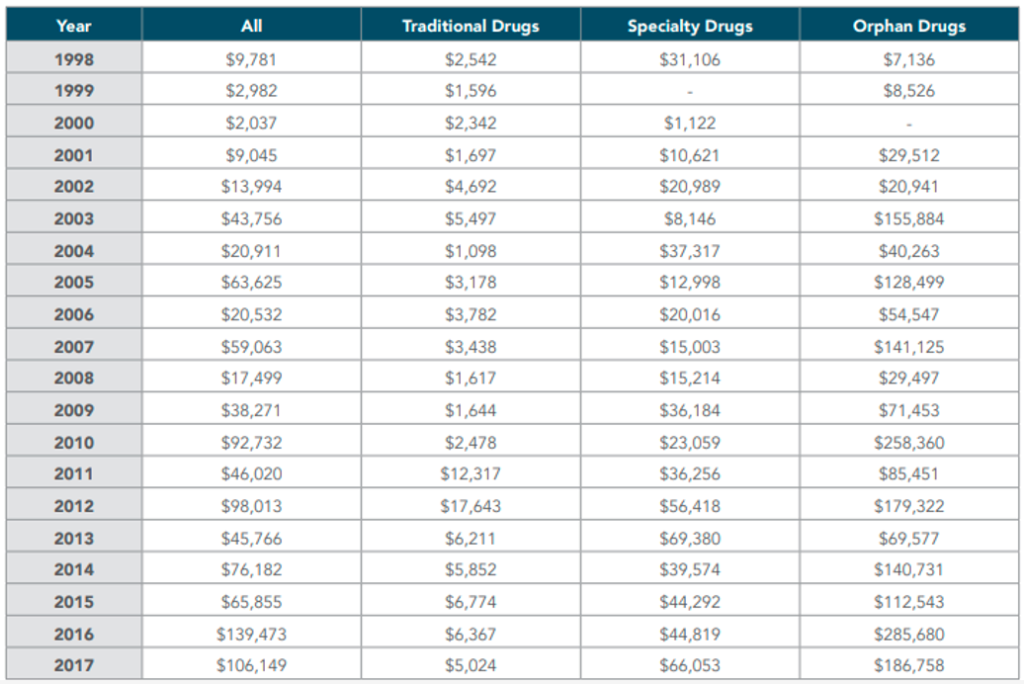

Spark Therapeutics’ Luxturna, a gene therapy approved by the FDA in 2018, for the treatment of patients with a rare form of inherited blindness, for example, comes in at USD 425,000 per eye (so USD 850,000 per patient), making it the most expensive pharmaceutical in the USA. The ascent of orphan drugs has not only transformed treatment landscapes but has also impacted prescription drug costs. A comprehensive analysis reveals a significant surge in average annual drug costs, especially for orphan drugs.

Over a 20-year span, the average annual cost for traditional and specialty drugs doubled, while orphan drugs witnessed a staggering 26-fold increase—from $7,136 in 1997 to a substantial $186,758 in 2017. Further scrutiny of the two decades illuminates a consistent upward trajectory, with the average annual cost for orphan drugs nearly doubling from $77,828 in 1998-2007 to $138,919 in 2008-2017. This profound escalation underscores the substantial influence of orphan drugs on the overall prescription drug landscape, posing new challenges in cost management and healthcare economics. With six-figure price tags, several CAR-T cell therapies are expected to reach blockbuster status.